are campaign contributions tax deductible in 2019

The other 39 states restrict the amount of money that any one individual can contribute to a state campaign. The answer is a stone cold NO.

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst

The bottom line is if you dont itemize and take the standard deduction you cant deduct charitable donations.

. Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. As a result you may not itemize deductions this year even if youve consistently done so in the past. Yes you can deduct them as a Charitable Donation if you file Schedule A.

Contributions or gifts to the peoples campaign are not tax deductible. For example Connecticut restricts individual spending to 1000 for a candidate in a state senate race and 250 for a candidate for a state house seat. Can I deduct my contributions to the Combined Federal Campaign CFC.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible it says in IRS Publication 529. According to the IRS the answer is a very clear NO.

Fully one-fourth of these contributions come from donors living. With the 2020 elections behind us and tax-filing season now here you might be wondering whether or not you can deduct political contributions you made last year. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible.

31-2019 meanwhile reiterates the issuance of non-VAT official receipts for every contribution received whether in cash or in kind valued at fair market value. For 2019 each individual is allowed to take 12200 off of income while couples can take 24400 off. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor.

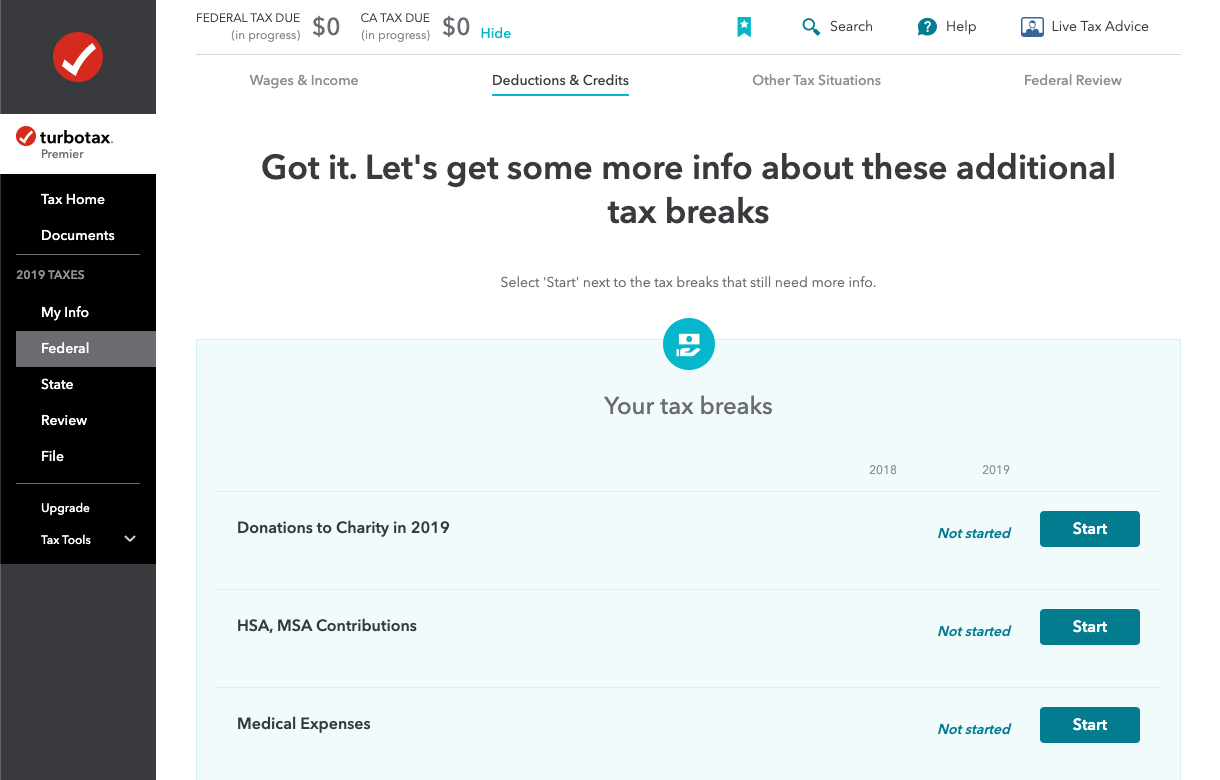

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. While inside the software and working on your return type charitable donation in the Search at the top of the screen you may see a magnifying glass there. A state can offer a tax credit refund or deduction for political donations.

Are campaign contributions tax deductible in 2019 Monday March 14 2022 Edit While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to support political candidates. Are Political Contributions Tax. Wrongfully claiming political contributions can and will attract the attention of the Internal Revenue Service and can lead to an assessment of additional taxes due penalties and interest.

How to get to the area to enter your donations. For 2019 the standard deduction is 12200 for single filers and 24400 for joint filers. You cannot deduct expenses in support of any candidate running for any office even if you are spending money on your own campaign.

Political donations are not tax deductible on federal returns. Ad We Maximize Your Tax Deductions Credits To Ensure You Get Back Every Dollar You Deserve. Ad A Bit of Planning Now Can Keep You From Tax Filing Troubles Next Year.

The answer is no political contributions are not tax deductible. Taxes Can Be Complex. But when it comes to individual states thats not the whole story.

50 limit on anonymous contributions. While there is no tax benefit in Michigan or in my brothers home state for giving to federal state and local candidates several other states do offer varying tax benefits for political donations. The IRS is very clear about whether you can deduct political campaign contributions from your Federal income taxes.

Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. The irs explicitly says that contributions to political campaigns and candidates are not tax. Check For the Latest Updates and Resources Throughout The Tax Season.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Campaign contributions and the tax implications. You can obtain these publications free of charge by calling 800-829-3676.

As circularized in Revenue Memorandum Circular RMC 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the candidate to whom they were given the reason being that such contributions were given not for the personal expenditure or enrichment of the concerned candidate but for the purpose of utilizing. Learn how campaign contributions can be used when an election is over. Donations utilized before or after the campaign period also do not qualify for donors tax exemption and allowable deduction.

No political contributions are not tax-deductible. These limits are typically dependent upon the office the candidate seeks. On the part of the candidate to whom the contributions were given Revenue Regulations 7-2011 provides that as a general rule the campaign contributions are not included in their taxable income.

The 2019-2020 contribution limit was capped at 2800. Qualification and registration fees for primaries as well as a legal expenses related to a candidacy are not deductible either. But the federal tax code doesnt allow you to take a deduction for any political donations you make.

The answer is no political contributions are not tax deductible. Special 300 Tax Deduction The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they dont itemize. Individuals can donate up to 2900 to a candidate committee per election up to 5000 per year to a PAC and up to 10000 per year to a local or district party committee.

Charitable Deductions On Your Tax Return Cash And Gifts

Tax Deductible Donations Rules And Tips

Donation Pledge Card Template 8 Sample Pledge Forms Pdf Word Pledge Lesson Plan Template Free Card Template

Pin By Lynn Schulkins On 9 11 Instagram Photo Photo And Video Instagram

Are Political Contributions Tax Deductible H R Block

How To Maximize Your Tax Deductible Donations Forbes Advisor

Roth Ira Vs Traditional Ira Vs 401k Vs Roth 401k Roth Ira Traditional Ira Ira

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

Are Political Contributions Tax Deductible H R Block

Are My Donations Tax Deductible Actblue Support

Fundraising Donation Letter For A Sick Person Donation Letter Fundraising Letter Sample Fundraising Letters

Maximum Contribution Limits For Retirement Plans 401k Ira Retirement Planning Tax Deductions Retirement Income

Are Political Donations Tax Deductible Credit Karma Tax

We Thank Each And Every One Of You Who Have Been A Part Of Our Contribution And Has Helped Make This Campaign A Success T You Better Work No Response Thankful

Campaign Finance Info Pittsburghpa Gov

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst